32+ low credit score mortgage loans

The VA has no minimum limit but lenders. Web Home loans for borrowers with low credit scores If you have a lower credit score you may not qualify for a Conventional home loan.

What Credit Score Is Needed To Buy A House Chapter 4 Intuit Mint

Web Credit scores typically span from 300 to 850 with higher scores representing a better credit history and making you eligible for lower interest rates on loans the Consumer Financial Protection.

:max_bytes(150000):strip_icc()/thinkstockphotos-178461378-5bfc3526c9e77c005878d646.jpg)

. Web For example if you take out a 150000 loan on a purchase with a 5 down payment you would pay 12125 a month in mortgage insurance with a 620 credit score or no credit score. This bank provides loan terms up to 7 years and is typically an excellent choice if you want a personal loan with low salary. Web Types of loans Conventional loans FHA loans VA loans and Jumbo loans Terms 8 29 years including 15-year and 30-year terms Credit needed Typically requires a 620 credit score.

25 discount on loans for those who opt to set up automatic payments. Instead you might need to consider one of these mortgage options. For example if you buy a home for 200000 and you have a 20 down payment youll bring 40000 to the table at closing.

In either case the home serves as collateral for the loan meaning the lender can foreclose on your home if you default on the loan. We recommend no more than 25 of your take-home pay. Web If you have a lower score you could spend several thousand more in interest over the life of your mortgage.

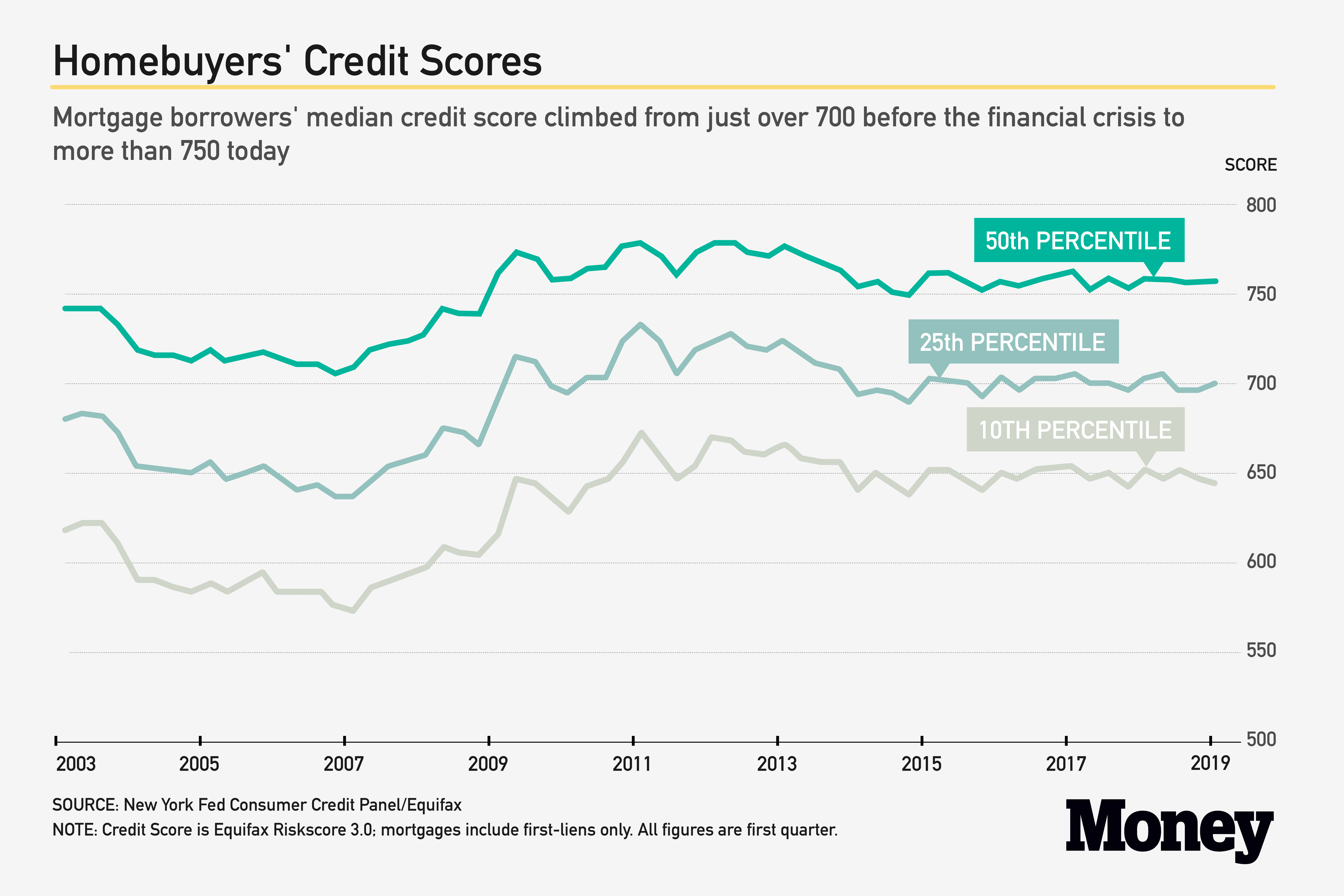

As you can see the differences between credit score ranges are just fractions of an interest point. Explore Car Leasing Financing. However the type of FICO Scores they request are often older versions due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac.

500 Down Car Loans. Web Loan Type. No Money Down Car Loans.

50 Minimum down payment. Web Heres 5 easy steps to getting a no credit score loan. Web Some lenders cater to applicants with lower credit scores in the poor range below 580 to help them borrow money for emergency expenses a medical bill debt consolidation and other financing.

The average credit card rate to own levels assessed. Web Heres an example of how a low credit score can impact the interest rate and total loan amount on a 350000 30-year fixed-rate mortgage. Federal Housing Administration FHA offers government-backed home loans with more lenient terms.

According to Experian bad credit is any score below 580 though the scores can be broken down as follows. With a 680 credit score the monthly mortgage insurance would only be 5875 a month which is a savings of 6250 per month. Web Your FICO score named for the Fair Isaac Corporation will range from 300 to 850 with higher numbers reflecting good credit.

Bad Credit Lease Deals. Check out the How Much House Can I Afford. FHA loans mortgages backed by the Federal Housing Administration have the lowest credit score requirements of any.

They also provide a 0. Web Call 855 439-0814. Lets face it not everyone has the best credit score or a ton of money to put down on a car these days.

Exceptional credit 800 and above Very good credit 740 to 800 Good credit 670 to 740 Fair credit 580 to 670 Poor credit under 580 Even if you have low credit there are still options for buying a home. But its the lender that ultimately decides what the minimum. Web Home Loans for Low Credit Scores Home loans are available to low-credit-score consumers looking to buy a new home or refinance their current one.

Credit debt surges once the unsecured loans render a cheaper choice. Web 7 Bad credit home loan options. Web A down payment is the first payment you make toward the home and its due when you close on your home loan.

500 with 10 down payment. Carrington has an A rating from the BBB. Web All of Carringtons government-backed loan options which include its FHA USDA and VA mortgages allow credit scores as low as 500.

These institutions often have less stringent regulations than banks and. Web Government-backed loan programs FHA VA and USDA generally have lower credit score requirements than conventional mortgages. 580 with 35 down payment USDA loans.

600 conventional loans Maximum debt-to-income ratio. Calculator to help you crunch the numbers. Approaching a Non-Banking Financial Company NBFC One option is to apply for a home loan with a Non-Banking Financial Company NBFC or a Housing Finance Company HFC.

Car Loans for Bad Credit. Fill out the form and connect with one of our Home Loan Specialists. In contrast to playing cards personal loans generally bring all the way down repaired interest rates.

Web You can travel to Reputable to compare personal bank loan interest rates to own free without affecting your credit score. Web Minimum credit score. Web On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more over 30 years compared to having a credit score of 760.

You will not be able to get approved for a conventional loan if your low credit score is 580 or lower. Lenders usually calculate your down payment as a percentage of the total amount you borrow. First lets take a look at the credit score ranges from FICO.

500 credit is the minimum to qualify for an FHA loan. Web When you apply for a mortgage lenders will generally request all three of your credit reports one from each credit bureau and a FICO Score based on each report. FHA loans The US.

Second Chance Car Loans. Web Marcus by Goldman Sachs offers low interest rates loan amounts up to 40000 and flexible repayment plans. Web FHA loans allow FICO scores as low as 500 and VA loans have no minimum credit score Portfolio lenders keep non-prime loans on their own books and accept bad credit and scores as low as 500.

Determine how much you want your mortgage payment to be each month. Web What Credit Score Do I Need To Buy a House. 3 Learn More Pros and Cons Pros Offers multiple options with low down payment.

Web The typical FHA limits allow for a DTI of 43 but higher ratios up to 569 are permitted with compensating factors for FHA loan low credit borrowers. Our example doesnt factor in property taxes homeowners insurance mortgage insurance or other fees. Web Several options are available for individuals to get a home loan with a low CIBIL or Credit score.

Assume you get a 350000 30-year mortgage with a fixed 45 percent rate.

13 Best Mortgage Lenders Of 2023 For Low Or Bad Credit Score Borrowers Nerdwallet

Mortgage Blog News And Tips Valley West Mortgage

3 Loan Documents You Should Know Valley West Mortgage

The Best Mortgage Lenders For Low Credit Scores Of February 2023

Home Loans For Bad Credit 7 Loan Options For 2023

:max_bytes(150000):strip_icc()/Bettercom-6fad5a211e0948e69168e6e275cb6153.jpg)

Best Mortgage Lenders For Bad Credit Of 2023

:max_bytes(150000):strip_icc()/SWBC-logo-37758f2b384c4360bcf1e3ad3706bdba.jpg)

Best Mortgage Lenders For Bad Credit Of 2023

Best Mortgage Lenders For Bad Credit Of Feb 2023 The Motley Fool

Financial Assumptions Wont Help You Buy Your Dream Home

Best Mortgage Lenders Of 2023 If You Have A Bad Credit Score

The Best Mortgage Lenders For Low Credit Scores Of February 2023

This Is The Credit Score You Need For A Mortgage Money

Best Mortgage Lenders For Bad Credit Of Feb 2023 The Motley Fool

List Of Top Personal Loan Providers In Shirdi Best Personal Loans Online Justdial

Valley West Mortgage Mortgage Services Las Vegas

5 Ways To Quickly Improve Your Mortgage Credit Score

What Credit Score Do You Need To Qualify For A Mortgage Loan Eric Almquist Benchmark Mortgage